Top Ideas For Selecting Credit Card Apps

What Can I Do To Determine If My Credit Card In The Us Was Reported As To Be Lost?To check whether your credit card was reported as stolen in the USA take these steps: Contact Your Credit Card Issuer-

Call the customer support number printed on the backside your credit card.

You can ask the representative to verify the status of your card.

You could be asked to reveal information regarding your personal identity and credit card for verification.

Check Your Online Account-

Log into the online banking system or account associated with the card.

Keep an eye out for any notifications or alerts related to the status of card.

Examine recent transactions to determine any suspicious or illegal activity.

Monitor Your Credit Report-

Obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, TransUnion) through AnnualCreditReport.com.

Look for suspicious credit accounts or inquiries on your report that could indicate fraud.

Fraud Alerts and Security Freezes--

You may want to consider placing a credit freeze or fraud warning on your credit report in the event of fraud or identity theft is suspected.

A fraud alerts lenders to verify you before giving credit. The security freeze in contrast, restricts your access to your report.

Stay Alert and Report Suspicious Behavior

Monitor your statements for credit card transactions. Notify the credit card company in the event of suspicious or unauthorized transactions.

Report any suspected fraud or cases of identity theft to your local law-enforcement agency and the Federal Trade Commission.

By contacting your bank, examining your account's history online, monitoring the status of your credit score and staying alert for indications of unauthorized transactions or suspicious transactions, you can ward off fraudulent use of your credit card.

What Does It Mean For My Credit Card To Be Listed On Blacklists?

A Blacklist's presence can restrict a card's use or transactions until an issue is resolved. A credit card may be placed on a "blacklist" due to a variety of reasons. They include:

Suspected Fraud: Unusual or suspicious transactions with the card that cause fraud detection systems to be activated could result in the card being removed to protect the card.

Security IssuesIf there are signs of potential compromise like unauthorized access, a data breach that involves the card's information or unusual spending patterns or spending patterns, the card could be considered a security risk.

Identity Verification Problems- Issues with verifying the identity of the cardholder in transactions could result in temporary blocking of the card in particular when additional confirmation is required.

Card which has been stolen or stolen - The card issuer could disable the card if the cardholder declares it missing or stolen. This prevents unauthorised use of the cards until the replacement card is received.

Indicators of suspicious activity- Any actions or behavior that is associated with the card that raises suspicions (such as several declined transactions or geographical anomalies) or any other unusual spending pattern, may trigger the issue of a temporary suspension.

If a card is listed in a "blacklist", the holder could not gain access to credit or use their credit card until the issuer has checked the legitimacy of the card, or has resolved any concerns regarding security or fraud. To fix the problem and verify the validity of any transactions, it's essential that the cardholder contact the card issuer as quickly as possible.

How Do Cybersecurity Experts Be Aware Of Cyber Threats And Detect Them Such As Compromised Credit Card Information?

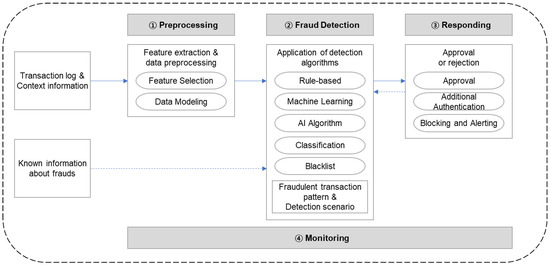

Security experts employ a variety of methods, tools, or techniques to identify, monitor, and detect cyber threats. This includes compromised credit cards information. Some of the common methods and practices include- Threat Intelligence Gathering-

It is crucial to gather data from multiple sources, such as threat intelligence feeds (such as forums) and dark web monitoring and security alerts to keep up-to-date with new threats and vulnerabilities.

Network Monitoring & Intrusion Detection

Check the traffic on your network using specific tools or software. Detect anomalies or suspicious behavior that may indicate unauthorised entry or data breaches.

Penetration and vulnerability tests-

Regular checks can help to find weak points in networks, applications, and systems. Testing for penetration involves the use of the use of simulated attacks to reveal weaknesses and evaluate the company's security measures.

Security Information and Event Management Systems (SIEMs)

Implementing SIEMs to analyze and consolidate log information (from firewalls or servers, applications, and firewalls) to identify, track, and react immediately to security breaches.

Behavioral Analysis

Conducting behavioral analyses to find patterns that are unique or are different from the usual behavior of users in the network or system, that could indicate a possible breach.

The threat of Hunting

By studying logs and information from systems, you are able to identify threats to your company's network.

Endpoint Security Solutions-

Installing endpoint security solutions (such antivirus, antimalware, as well as detection and response tools to devices) is a great way to safeguard your devices from malicious activity.

Data Security and encryption

Implementing encryption techniques in order to secure sensitive information like credit cards as it is transmitted and stored can reduce the chance that data breaches will occur.

Forensics and incident response

In order to quickly respond in the event of security breaches, an incident response planning is necessary. Conducting forensics to study, identify the consequences and quantify them of security breaches.

Security experts from Cybersecurity combine this method with a comprehensive understanding of the changing cybersecurity threat, compliance rules and the best practices to detect, limit and respond to cyber-attacks such as those that result in compromised credit card information. For a solid defense against cyber attacks it is essential to stay on top of continuous surveillance, information and proactive measures. View the most popular savstaan0.cc for website info.